- #Schedule j line 4 ohio state tax form how to

- #Schedule j line 4 ohio state tax form update

- #Schedule j line 4 ohio state tax form series

- #Schedule j line 4 ohio state tax form download

Also include amounts from Schedule M, line 5 (Form 740-NP, page 4, line 16) that reflect pension and IRA. We have more than 40 program areas serving our Ohio. Madden, is committed to providing quality centralized services, specialized support and innovative solutions to State agencies, boards, and commissions as well as local governments and State universities. Divide the annual Ohio tax withholding by 26 to obtain the biweekly Ohio tax withholding. Self-Employed Best for contractors, 1099ers, side hustlers, and the self-employed. tax return, Form 1040 or 1040-SR, line 4(b) or 4(d) Form 4972. 2021 Ohio IT 1040 Individual Income Tax Return - Includes Ohio IT 1040, Schedule of Adjustments, IT BUS, Schedule of Credits, Schedule of Dependents, IT WH, and IT 40P. The Ohio Department of Administrative Services (DAS), led by Director Kathleen C.Withholding Formula > (Ohio Effective 2020) 0.516%

#Schedule j line 4 ohio state tax form update

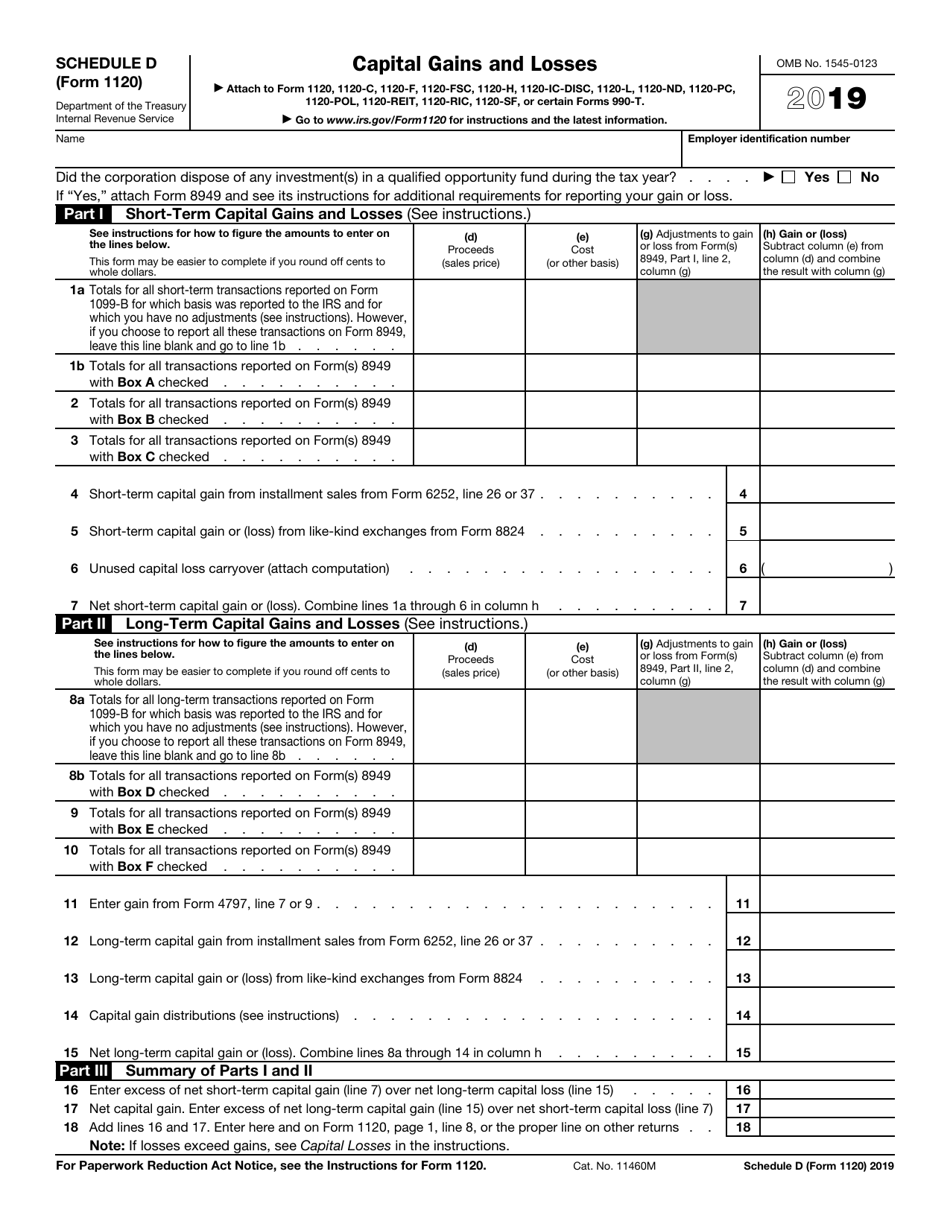

We will update this page with a new version of the form for 2023 as soon as it is made available by the Federal government. This form is for income earned in tax year 2021, with tax returns due in April 2022.

#Schedule j line 4 ohio state tax form how to

#Schedule j line 4 ohio state tax form download

You can download or print current or past-year PDFs of Form ET Schedule J Debts and Administration Expe directly from TaxFormFinder. List all tax withheld for your resident municipality in Column 3 ONLY (even if you worked in. Tax rate used in calculating Ohio state tax for year 2020ĭetermine the Total Number Of Allowances field as follows: First Position- Enter 0 (zero). We last updated the Schedule J Debts and Administration Expenses in March 2022, so this is the latest version of Form ET Schedule J Debts and Administration Expe, fully updated for tax year 2021. Generally, if you e-file and use direct deposit, the IRS estimates that you should receive your federal refund between 8 and 21 day s after they accept your return, unless the IRS does not send you a notification requesting.

Ohio State tax rate changed on Sep 1, 2013. In comparison, the IRS requires a different Form - Form 1040X -to amend an IRS return (do not use Form 1040 for an IRS Amendment).ĭid the IRS send you a notification to change an error on your current or previous Tax Return? Or, did you discovered an error on one of your Returns? In either case, if the IRS amended or changed one of your IRS Tax Return(s), the IRS will report this to the Ohio Tax Agency, thus you should file an Ohio Tax Amendment within one year. Be aware that you can change your filing status from married filing separately to married filing jointly on your amended return, but you can't change your status from married filing jointly to married filing separately.How to Print QuickBooks Checks on Blank Stock You can prepare a 2021 Ohio Tax Amendment on, however you cannot submit it electronically. Form IT-1040 is a Form used for the Tax Return and Tax Amendment. Instead, you will need to read the Schedule 4 line. The 2021 Schedule 4 Instructions are not published as a separate booklet. Form 1040 Schedule 4, Other Taxes, asks that you report any other taxes that cant be entered directly onto Form 1040.

#Schedule j line 4 ohio state tax form series

If you need to change or amend an accepted Ohio State Income Tax Return for the current or previous Tax Year you need to complete Form IT-1040 for the appropriate Tax Year (or IT-140X for 2014 and earlier Tax Years). You do not file IRS Schedule 4 with the older 1040 series forms such as Form 1040A or Form 1040EZ.

0 kommentar(er)

0 kommentar(er)